What Flood Insurance Does and Does Not Cover

Even if you don't live in an area prone to flooding, you may want to consider taking out a policy

After heavy rains caused the breach of two dams in central Michigan last month, thousands of residents around the overflowing Tittabawassee River and adjoining lakes saw their homes and communities inundated, and destroyed, by floodwaters.

Now, news reports say, many face rebuilding with little financial help. Their homeowners insurance won’t pay for most of the flood damage; that’s what flood insurance is for. But because the Michigan homeowners weren’t living in an area known to be flood-prone, most didn’t have that coverage.

If you don't have flood insurance and you’re hit by a flood, the damage can be costly, says Lizzie Litzow, a spokesperson for the Federal Emergency Management Agency. “Flooding is the most common and costly natural disaster and can happen anywhere,“ Litzow says. “Just 1 inch of water can cause up to $25,000 in damage to a home or apartment.”

The Cost of Flooding and Prevention

Most homeowners pay less than $400 per year for flood coverage in low- to moderate-risk areas, FEMA says. (The average annual flood insurance premium is about $700, with homeowners in high-risk areas that are prone to flooding paying much more.)

What's Covered

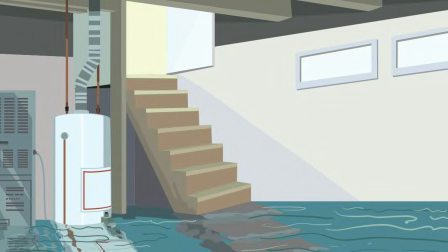

Essential systems in the home. This includes electrical and plumbing systems, furnaces, water heaters, central air conditioners, heat pumps, and sump pumps. It also includes cisterns and the water in them, fuel tanks and the fuel in them, solar energy equipment, water tanks, and pumps.

Appliances. Refrigerators, ranges, and built-in appliances, such as dishwashers, washing machines, and dryers, are usually covered. So, too, are portable window air conditioners, and freezers and the food in them.

Carpeting and window treatments. If you have permanently installed carpeting over an unfinished floor, or any other kind of carpets over wooden floors, your policy should cover them. Your policy should also include window blinds and curtains.

Permanently installed paneling, wallboard, bookcases, and cabinets. If you have to replace your cabinets, your policy will pay only for the ones that were damaged. If some cabinets were ruined but others were not affected, you might have trouble getting cabinets that match the older ones.

Foundation walls, anchorage systems, and staircases attached to the building. There is an exclusion for “loss caused directly by earth movement even if the earth movement is caused by flood.”

A detached garage, used for limited storage or parking. You can use up to 10 percent of your total building coverage toward your garage, but that amount will be subtracted from the total amount of building coverage available to you.

Personal property. This includes clothing, furniture, and electronic equipment—though only if they’re not stored in the basement.

Certain valuables. Your policy is likely to cover items such as original artwork and furs, up to $2,500 in value.

Other coverage. Some events are covered even if they’re not strictly floods, such as groundwater seepage and mudflow. These would include a neighbor’s above-ground swimming pool collapsing, causing the water to flow into your home, or a water main break that damages your home and at least one other in your neighborhood. However, damage caused by a sewer backup is covered only if it’s a direct result of flooding.

What's Not Covered

Flood insurance has eligibility requirements and numerous exclusions. According to the NFIP, the following kinds of damage are not covered by flood insurance:

- Damage caused by moisture, mildew, or mold that could have been avoided by the property owner or which is not attributable to the flood

- Damage caused by earth movement, even if the earth movement is caused by flood

- Additional living expenses, such as temporary housing, while the building is being repaired or is unable to be occupied

- Loss of use or access to the insured property

- Financial losses caused by business interruption

- Property and belongings outside of an insured building, such as trees, plants, wells, septic systems, walks, decks, patios, fences, seawalls, hot tubs, and swimming pools

- Currency, precious metals, and valuable papers, such as stock certificates

- Most self-propelled vehicles, such as cars, including their parts

Federal flood insurance coverage is also capped at $250,000 per building and $100,000 for contents, though you can purchase policies with lower limits.

There are separate deductibles for your dwelling and contents. Higher coverage limits are available for policies for nonresidential structures and their contents. Get more details from FEMA.

How to Buy Flood Insurance

You can buy national flood insurance issued by the NFIP through thousands of insurance agents nationwide.

Check with an agent who sells homeowners or renters coverage for details. If your insurance agent does not sell flood insurance, you can contact the NFIP Help Center, at 800-427-4661.

People who live in low- and moderate-risk areas and buy federal flood insurance pay standard premiums set by FEMA. These rates are the same regardless of where you buy your coverage.

To get an estimate of your annual premium and a link to agents who sell federal flood insurance, go to the FEMA Flood Map Service Center and enter your property address in the search bar. This will take you to the official flood insurance rate map for your area. To find a provider of flood insurance to your area, use the search tool at the NFIP’s website, FloodSmart.

You can also check My Flood Quote, a commercial site, to see your property on a flood map and get detailed estimates of premiums.

If you’re in a high-risk area, your premium is likely to be tailored to your property. According to FEMA, there are many variables that go into the pricing, including the age and construction of the home, its proximity to water, the elevation of the house, and the home’s value.

Renters, too, can get flood insurance. That may be particularly worthwhile if you live in a first-floor or below-ground apartment. As a renter, you’re entitled to buy coverage only for the contents of your apartment or house. You’re entitled to the same maximum coverage limit on the same items as homeowners: $100,000 for your home’s contents.

Consumer Reports also can help you find a homeowners insurance carrier with the best track record for claims and customer service.

Private Flood Insurance

Increasingly, private insurers are offering flood coverage. The policies either supplement federal flood insurance by providing higher coverage limits or replace it as the homeowner’s primary flood policy. A few insurance carriers provide it as an optional rider on their homeowners coverage.

Depending on your situation, you may find that private flood insurance has lower premiums than the federal version, says Craig Poulton, CEO of Poulton Associates in Salt Lake City, the underwriting manager and administrator of private flood insurer Natural Catastrophe Insurance Program.

Or it may require fewer add-on costs. For example, in about 20 percent of cases, the government will require that a professional come to the home to draft an “elevation certificate” to determine the insurance rate. The homeowner pays that bill.

In addition, private coverage may cover your living expenses if you have to relocate while your home is being cleaned up after a flood. That’s something federal flood insurance doesn’t provide.